There is an interesting dynamic unfolding in the housing market.? Real estate agents in places like California are arguing that there is a lack of inventory and are also generally against the government unloading blocks of properties to big investors.? Why?? There has been bulk selling and buying to the investor class and a large amount of crowding out has occurred.? This brings about an interesting set of problems for your average buyer in the current market.? They are competing with swaths of big investors but also local flippers trying to make a quick buck once again courtesy of low interest rates and another mania in some markets.? SoCal is now in a mania again as you will see with some of the patterns occurring.? This is also happening in many other states as well.? A new feudal system has emerged.? The banks were bailed out by the Fed, were allowed to circumvent accounting standards, and now deep pocket investors in the financial class are buying up these places either to increase prices on flips or to hike up rents.? In the end, if you want to compete in today?s market you need to bow down to the Fed, put on a football helmet and go head-to-head with big investors, flippers, suckers, and take on a massive mortgage.

Seeking out your own fiefdom

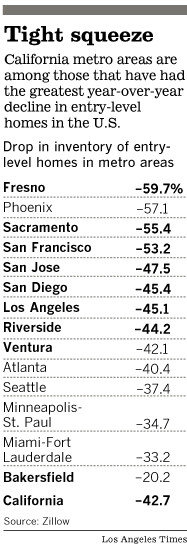

The Los Angeles Times highlighted the declining inventory for entry level homes with a stunning graphic:

?(LA Times) Rogers said he has gone into escrow twice and lost out both times, as other buyers have been willing to pay more. He has been shocked by competing investors paying $75,000 to $100,000 more than what he has estimated some homes to be worth.

The big speculators have pooled all their money; they invest and they bid them up,? he said. ?It?s crazy. Some of them, they pay pretty close to what it?s actually probably worth fixed up, but then by the time they put money into it, they are going to be $50,000 to $60,000 over.?

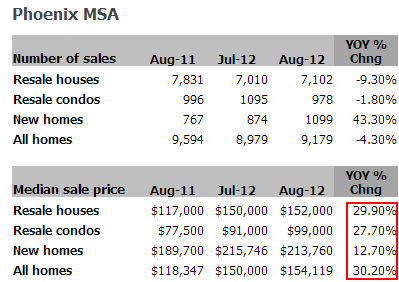

First some analysis of the chart.? The drop in inventory in various metro areas is stunning.? Keep in mind the demographics of your entry buyer.? They are younger Americans that are less affluent and very likely to be in student debt already.? Many markets in California are being crowded out from top-tier San Francisco to places like Fresno.? It is worse for places like Phoenix Arizona where a whopping 40 percent of all purchases were done with all cash.? The chase for yield has caused prices to surge in an area that is economically depressed and carries lower household wages:

Source:? DataQuick

The median price in Phoenix is up over 30 percent year over year.? You read correctly, the year over year median price is up by 30 percent.? Did incomes go up by this much?? Of course not.? For years you have nearly half of all properties being bought in this market going to investors.? Rent prices have surged while banks leisurely leak out inventory while shelling out the best deals to other financial institutions with deep wallets.? In other words all the bailouts were to create another bubble and crowd out the typical buyer and also, squeeze the wallets of many renters who probably are not able to buy.

Going back to the paragraphs above, the fact that investors are bidding prices up by $75,000 to $100,000 over market valuations in this current economy is very reminiscent to a mania.? If you view the world through the lens of a hammer everything looks like a nail.? These bulk investors are diving in head first here and entry level buyers are competing against large funds.? This bubble is different.? During the early 2000s you were basically competing against anyone with a pulse.? Today you are competing with big pocket investors, hedge funds, flippers, and large real estate investment funds.

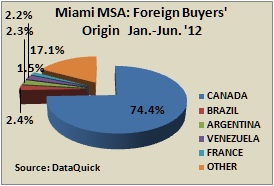

Hot money will go to many areas.? For example, the Canadian housing bubble is seeing a good portion of money leaking out into the Florida market:

Nearly 75 percent of foreign buyers in Miami come from Canada.? I wish we had figures like this for California but I would venture to guess that most of the foreign money coming in is from China (that is experiencing a housing bubble even bigger than the one we lived through).

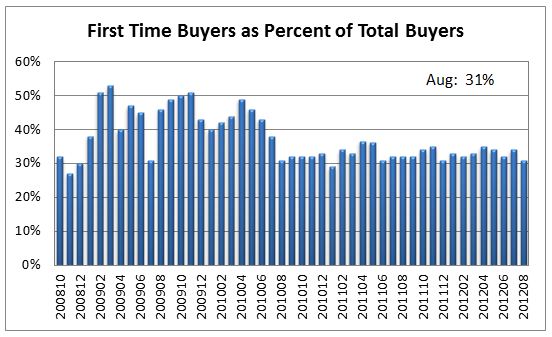

All this action has made it tougher for first time home buyers who need to over-bid or take on massive loans with the sticker price of low interest rates.? You would think that first time buying would be high but it is not:

Source:? NAR

The Federal Reserve is largely helping big financial institutions with QE3.? Those that own and can refinance lower save some bucks but this is merely an afterthought of the Fed action.? Big money is being made by the banking system right now.? You saw this week Wells Fargo announced stellar profits even in the midst of being sued for their FHA insured loan practices.? What is Wells Fargo being accused of?

?(SF Gate) Yet another major bank has engaged in a long-standing and reckless trifecta of deficient training, deficient underwriting and deficient disclosure, all while relying on the convenient backstop of government insurance,? said?Preet Bharara, U.S. attorney for the Southern District of New York, where the suit was?filed.?

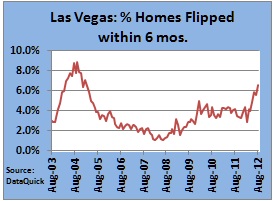

Why in the world would the Fed and government setup programs to bulk sell to investors when there is a clear demand from buyers?? We?ve already noted the amount of flippers entering the Southern California market.? Las Vegas is seeing an increase in flipping activity as well:

Just because money is cheap does not mean it is going to boost the economy.? Take a look at Japan and their multi-decade policy of quantitative easing.? We are juicing markets up in many areas and conditioning the overall economy to negative interest rates.? The crowding out is creating a new kind of landlord:

?Renting out foreclosed homes has increasingly emerged as an investment opportunity for Wall Street.

Financiers are busily studying ways to take the single-family home rental business, for years mostly a mom-and-pop affair, and make it a bigger industry. That has made it difficult for first-time shoppers to compete.?

So now you have to compete with Wall Street that receives favorable treatment from the government and Fed just to purchase an entry level home.? This is becoming a closed loop system.? The same financiers that made billions upon billions of dollars shelling out fraudulent loans and toxic waste are now gaining favorable treatment in locking up blocks of properties to jack up prices.? The California median price is up 12.9 percent year over year while incomes remain stagnant.? In Phoenix it is up a stunning 30 percent.? Las Vegas?? Up 18 percent year over year.? These gains are on par with the peak years of the bubble.? This mania is being caused by stringent control on distressed inventory and absurdly low rates courtesy of a Fed with a nearly $3 trillion balance sheet that is set to grow with QE3.

One of the quotes in the above article sums it up:

?Don?t sell to regular people ? just sell to us,? Monks said these investors have told him.?

Meet the new boss, same as the old boss.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

iOS 6 Yunel Escobar Eye Black Cruel Summer Endeavor mega millions shaun white carolina panthers

No comments:

Post a Comment